With a growing share of gold and other assets in reserves, India’s strategy echoes steps taken by larger holders such as China. (AI image)

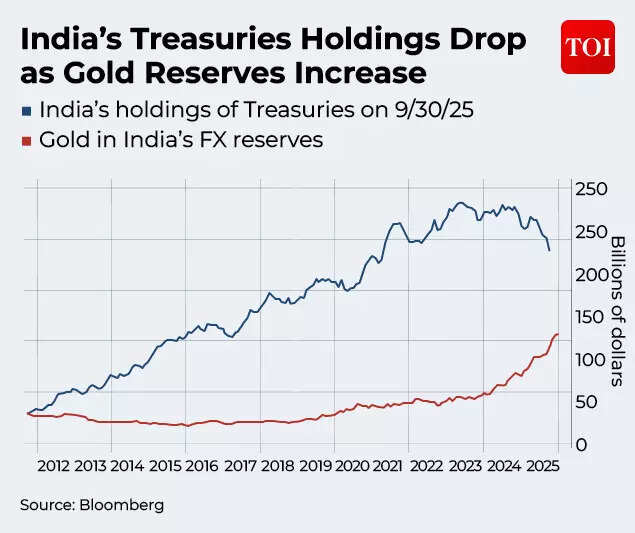

In a major turnaround for one of the top five largest economies, India’s share in the US treasury has seen a decline, falling to the lowest level in five years. The reason for the decline is both necessity-based and strategic: the rupee is depreciating, making it one of the worst-performing Asian countries last year. The second reason is to strategically change the composition of foreign exchange reserves, reducing dependence on US assets. In fact, most economies around the world are reducing their dependence on the world’s largest bond market.US government data released last week showed India’s long-term US debt stake has fallen to about $174 billion. This represents a massive decline of 26% from the peak recorded in 2023. According to the Reserve Bank of India, treasuries now make up about one-third of the country’s foreign exchange reserves, down from about 40% a year ago.

India, China and the world moved away from the US treasury

With a growing share of gold and other assets in reserves, India’s strategy echoes steps taken by larger holders such as China, according to a Bloomberg report.This has reignited the debate over US financial dominance and its debt’s status as a preferred reserve instrument. US President Donald Trump’s latest trade threats related to Greenland have heightened global uncertainty, fueling speculation that European countries may also reduce their exposure to US treasuries.

India’s treasury holdings have declined due to increase in gold reserves

Win Thin, chief economist at Bank of Nassau 1982 Ltd., said the trend reflects an effort to cut reliance on dollar-denominated assets to reduce sanction-related risks. “India still has scope to lighten its fiscal reserves,” he said.In September, Finance Minister Nirmala Sitharaman had said the RBI was taking a “very thoughtful decision” to diversify the country’s reserves.

Why is reliance on dollar-denominated assets being reduced?

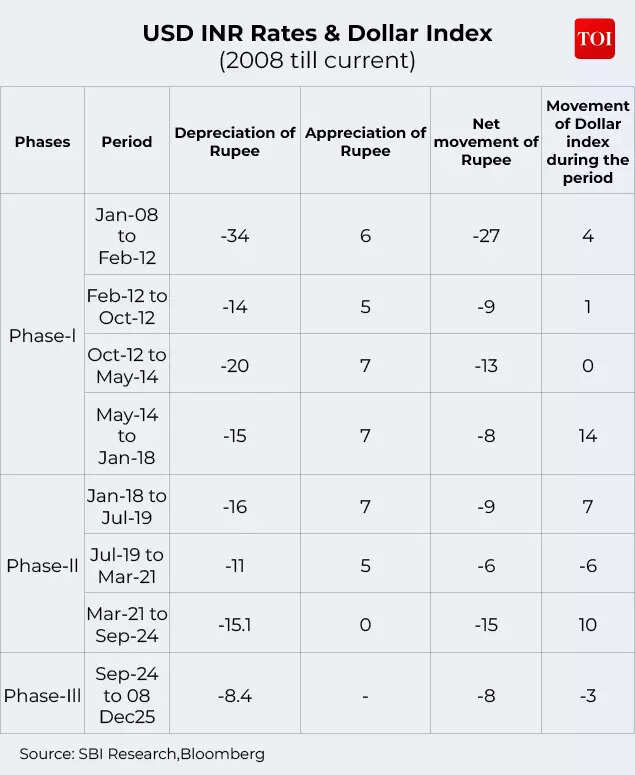

For India and other countries, these lessons are shaped by the US decision to freeze Russia’s foreign exchange reserves following the war with Ukraine that began in February 2022. India’s decision to continue importing Russian oil has subsequently become a point of contention with US President Donald Trump. Even an additional 25% punitive tariff has been imposed.“The speed at which relations between the US and India deteriorated last year may have surprised many and jolted policymakers into reducing their vulnerabilities,” said Shilan Shah of Capital Economics, who topped Bloomberg’s rupee forecast rankings last quarter.Another factor influencing this change is the Reserve Bank of India’s efforts to strengthen the rupee, which has hit a record low due to the delay in finalizing the US-India trade deal following the Trump administration’s move to impose 50% tariffs on Indian exports, a tariff rate that is the highest in Asia. By cutting US Treasury holdings, the central bank can deploy those funds to buy rupees and support the currency.In financial markets, President Trump’s increased use of the dollar as a trade tariffs and sanctions tool has prompted renewed debate over the safety of US Treasuries as a reserve asset, with recent actions against Venezuela also reinforcing those concerns.

USD INR Rates and Dollar Index

While the RBI is not among the largest holders of U.S. government debt, with its exposure as of November amounting to about $683 billion of China’s holdings and nearly a quarter of Japan’s $1.2 trillion portfolio, the Treasury’s foreign ownership remains near record highs. Nevertheless, India’s sale has given new impetus to the discussion about the place of US sovereign bonds in global investment portfolios.Central banks around the world are grappling with a more complex policy environment, putting additional pressure on how they allocate reserves, Bloomberg reports. While the US dollar and Treasuries continue to dominate as global reserve assets, there is clearly growing momentum towards diversifying into other alternatives.In this backdrop, the reduction in treasury holdings by the Reserve Bank of India comes as a step towards buying gold. In fact, India currently has the 7th largest gold reserves in the world. Other countries are also taking similar steps. China and Brazil reduced their long-term Treasury holdings in October to their weakest levels since at least 2011, with China also increasing gold purchases. The shift toward gold has gained momentum elsewhere too. Earlier this week, the National Bank of Poland, currently the world’s largest buyer of gold, approved a plan to add 150 tons of the metal to its reserves.There are factors that could slow the pace of India’s selloff, including a more stable rupee that reduces the need for currency intervention, or a reduction in geopolitical tensions if the delayed trade deal is ultimately concluded. “If the trade agreement is successful, the need for aggressive currency defense may be reduced,” said Krishna Bhimavarapu, Asia Pacific economist at State Street Investment Management. Nevertheless, many analysts believe the widespread reallocation toward alternative assets is likely to continue. A survey conducted in November by think tank OMFIF showed that while most central banks still hold the dollar, about 60% intend to explore alternatives over the next one to two years. “The trend is very underlying at this point,” Michael Brown, senior research strategist at Pepperstone in London, said of India’s Treasury sales, adding that a trade deal would “only stabilize holdings, not cause India to go on some kind of massive buying spree.”

.jpg?w=3800&h=2000&w=150&resize=150,150&ssl=1)