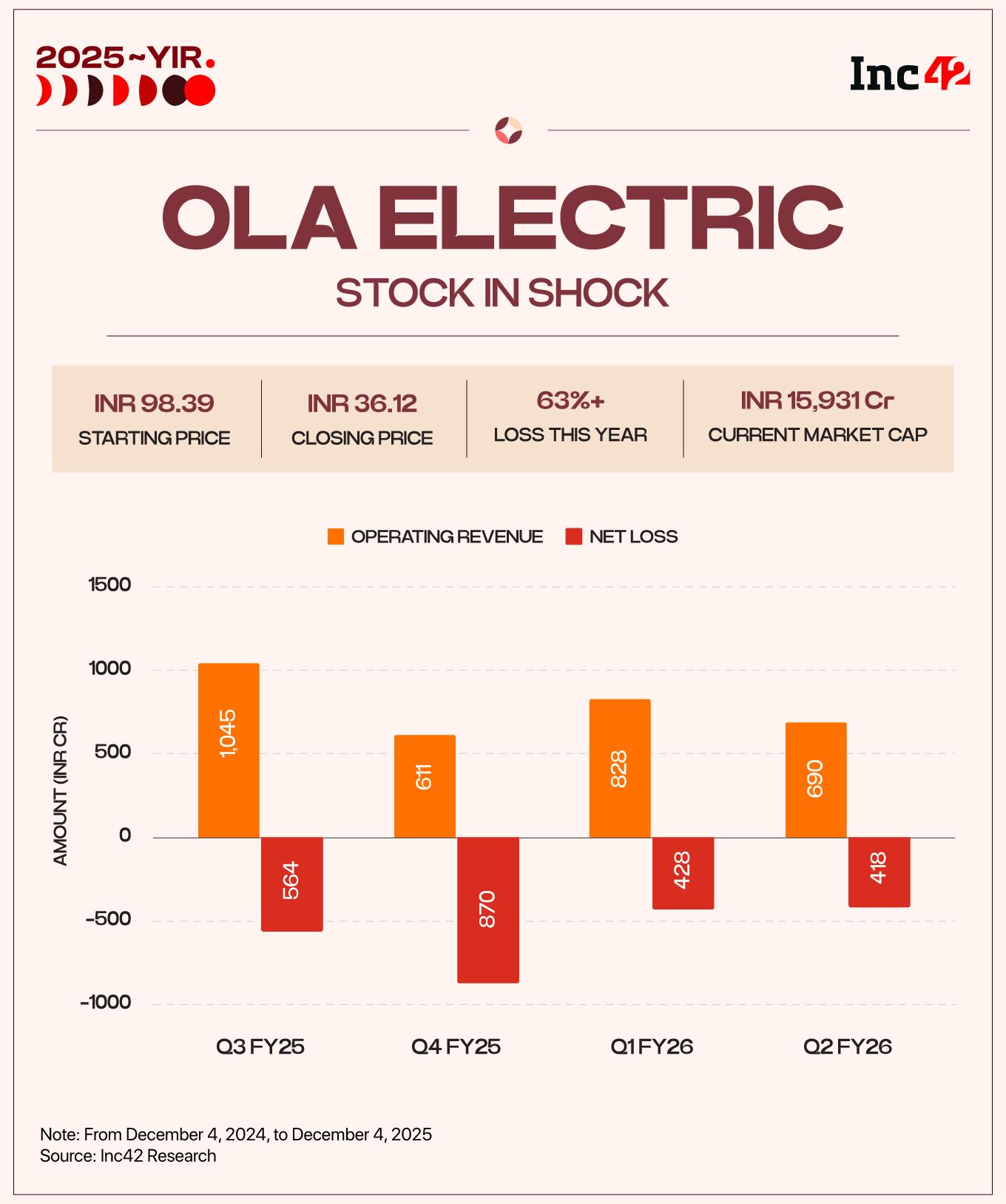

If there is one indicator to summarize Ola Electric’s year so far this year, it is its share price, which has skyrocketed 57% (as of December 5, 2025) to INR 36.12 from January 1, 2025. The electric vehicle maker, which not long ago had a market capitalization of $5.4 billion, has shrunk to a rolling capitalization of about $1.7 billion.

So what happened to Electric Wave

To understand this, let’s look at how 2025 played out for the electric vehicle maker: the strides it made, the major wins it achieved, and the areas where it fell short.

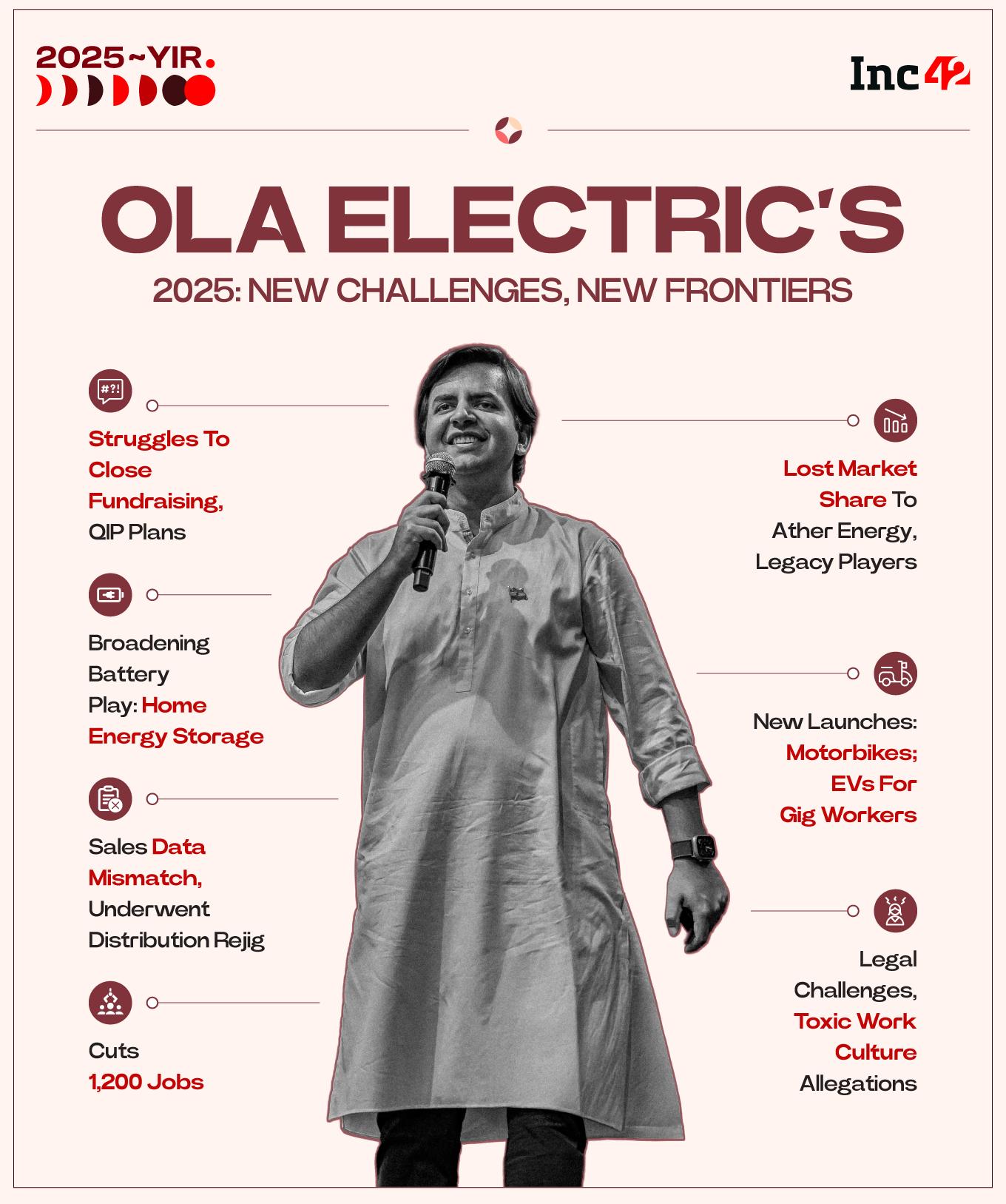

Our analysis reveals that Ola Electric’s year so far has been marked by regulatory setbacks, reputational damage, operational failures, revenue contraction, product delays and strategic zigzags, which together have dragged the company down.

Furthermore, persistently poor after-sales services, an intensifying CCPA investigation, falling operating income and declining sales figures remained the highlights for Ola Electric during the year and the full extent of its problems are far from over.

- Nearly 70% of shops in Maharashtra were allegedly operating without trade licences.

- There were several discrepancies in the reported sales figures.

- A fundraising within a year of going public, without clarity on capital allocation

- LG’s accusation of stealing its battery technology

- Repeatedly missed deadlines for marketing its battery pack and two-wheeler deliveries

- Alleged toxic work culture and employee deaths

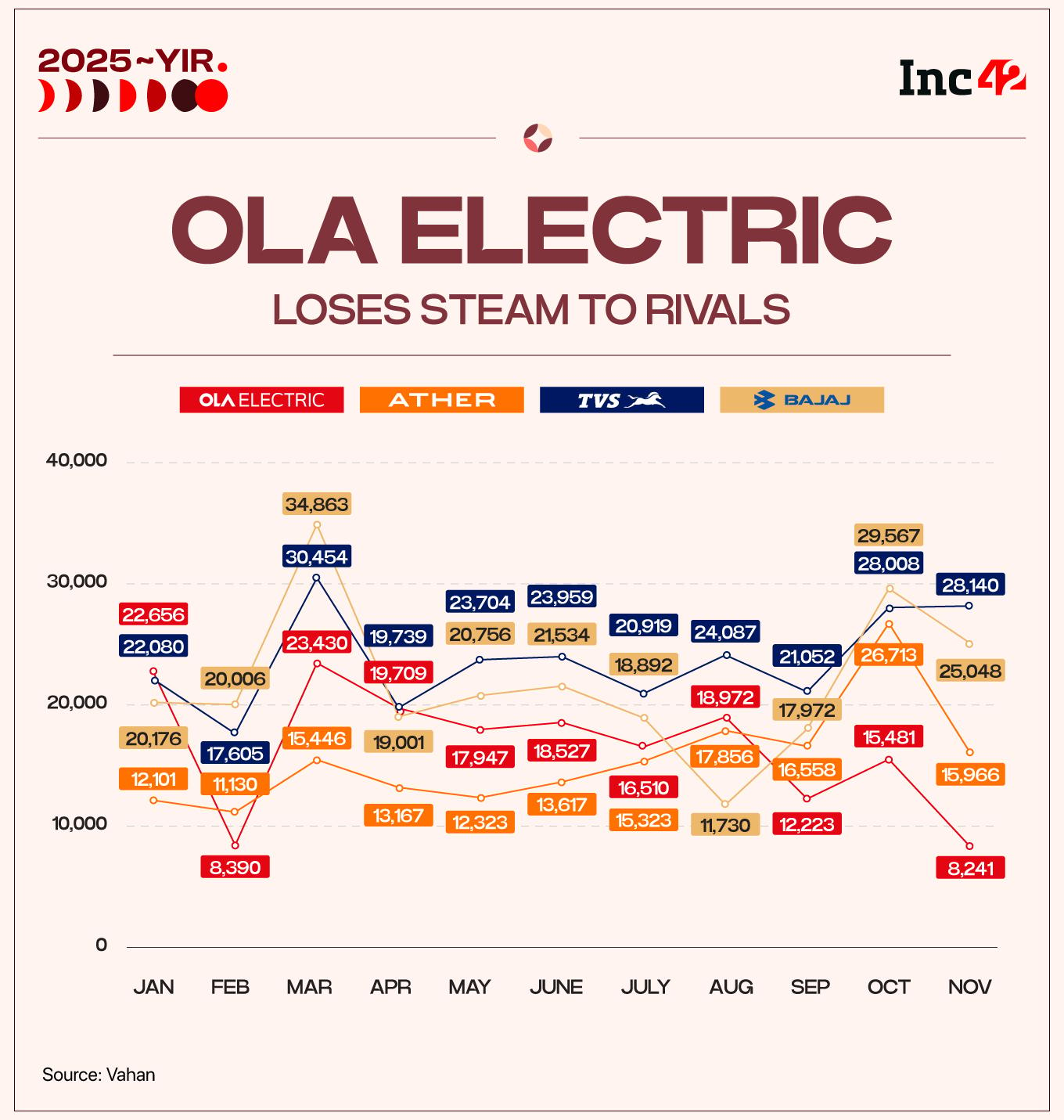

On an individual level, each of these issues was enough to shake end users’ trust in the company. Result? Ola Electric, once the undisputed leader in India’s electric two-wheeler landscape, now accounts for just 7% of the market, ranking fifth, according to VAHAN data.

What broke Ola Electric’s growth engine?

Ola Electric’s two-wheeler business is currently characterized by regulatory scrutiny, disgruntled customers and a rapid erosion of its market share. However, the Bhavish Aggarwal-led electric vehicle maker had it coming.

The most pressing challenge of the year came from the Central Consumer Protection Authority (CCPA), which intensified its investigation after receiving more than 10,000 complaints in a single year. These complaints ranged from consumer rights violations and misleading advertisements to refund disputes and persistent service failures. In October 2025, Ola had received a formal investigation report and was summoned to a hearing.

Despite CEO Bhavish Aggarwal’s repeated assurances that “service issues are behind us,” public sentiment tells a different story. A quick look at social media still reveals a steady stream of unresolved complaints.

Physical assessments at service centers paint an even bleaker picture: overwhelmed facilities, a backlog of vehicles left unattended for weeks, overcrowded parking lots and a workforce unable to match the pace at which Ola has increased its sales.

The service network expanded more slowly than vehicle volume, a structural mismatch that ultimately led to a reputational disaster.

In Goa, service failures sparked mass protests, forcing state authorities to consider punitive measures, including suspension of licenses, earlier this month.

Delays in deliveries further eroded customer confidence.

It then quietly discontinued its affordable range of scooters, Ola Gig and S1 Z, even though they had been launched just a year earlier.

Instead, Ola said it would focus on the Ola Roadster electric bike. Ironically, the Roadster was postponed three times before its eventual launch in May.

“In the automobile world, you have to make a great product before launching a new product. They should have perfected the scooter before entering the bicycle market,” said Deb Mukherjee, an automobile industry veteran.

Additionally, the company’s attempts to address service issues have not yielded significant results to date. The much-hyped one-day service guarantee largely failed to meet real-world demands, forcing Ola to pivot again by opening up its HyperService platform, allowing customers to purchase genuine spare parts.

The commercial consequences have been significant.

Ola revised its sales guidance for FY26 from 3.25 Lakh units-3.75 Lakh units to 2.2 Lakh units in First Quarter FY26. Delivery projections for the second half of the fiscal year have been reduced to around 1 Lakh, indicating a strategic shift from hypergrowth towards margin protection.

This led to a downward revision of its full-year (FY26) revenue guidance from INR 4,200 – 4,700 Cr to INR 3,000 – INR 3,200 Cr in Q1FY25.

Meanwhile, the competitors pressed on. Vahan data shows that Ola’s market share has dropped to 7% since 18.7% in the same period last year. Ola Electric now holds the position fifth in the electric two-wheeler race, behind Ather, Bajaj, TVS and Hero.

The bet on the battery that has not yet been fulfilled

At the same time, Ola Electric tried to redouble its commitment to the construction of indigenous batteries. The company faltered again due to aggressive goals and a lack of operational discipline.

The company’s gigafactory schedule is a prime example of this.

- Earlier in FY25, Ola launched phase 1A of its gigafactory with 1.5 GWh capacity, projecting:

- 5 GWh by October 2025

- 20 GWh in later phases

- For Q4FY25, the 5 GWh target has been postponed to early FY27.

- For Q1 FY26, the target date changed again: 5 GWh by the end of FY26 and 20 GWh no earlier than FY29.

- Now, in Q2FY26, the company intends to expand its capacity to 5.9 GWh by the end of FY26 and to 20 GWh by the second half of 2027.

Such frequent restarts indicated uncertainty, not progress. This raises questions about the viability of OLA’s PLI benefits, with reports suggesting the company could miss critical milestones linked to the incentives.

The marketing of Ola’s indigenous battery packs was also delayed. Aggarwal had promised that Ola scooters would be powered by internal cells by early 2025, but reality says otherwise.

The ARAI certification of the 4680 Bharat Cell was obtained last month and deliveries of S1 Pro+ vehicles with the new battery pack began in December.

To further complicate matters, a South Korean media outlet alleged that a former LG Energy Solution executive attempted to leak proprietary battery technology to Ola.

While Ola denied the charges, the episode fuels the perception that the company failed to keep its promises and relied too heavily on narrative instead of substance.

The battery vertical, conceived as Ola’s long-term moat, instead exposed its operational overload. Together, these had a negative impact on the company’s share price.

“It is the customer sentiments that have created negativity towards the company’s stock. The stock has fallen below the important moving average. This means more people are thinking about selling rather than holding. I think this is likely to remain the case,” said Rupak De, senior technical analyst at LKP Securities. He added that investors should set a stop loss of Rs 39.

A leap beyond mobility

In what could be one of the most unexpected turns of the year, Ola Electric has ventured beyond automotive and into the residential energy storage market, with Ola Shakti, an inverter-like system for home backup.

The moment has caught the attention of many. Just a quarter earlier, Ola had an immediate intention to increase its battery capacity beyond 20 GWh by FY29. With the launch of Shakti, the company suddenly projected to reach 20 GWh by the second half of 2027. This dramatic acceleration appears to be a quest to offset the decline in scooter sales.

Aggarwal sees FY26 as a “transitional year” and sees energy as Ola’s next growth driver. It projects revenue of INR 100 Cr from power segment for Q4FY26 and INR 1200 Cr for FY27.

Given Ola Electric’s track record, these projections are met with skepticism.

“Battery technology is a complex area and it takes decades for companies to master it. It is hard to believe that a company has developed battery technology in just two years and now Ola wants to power your home,” Mukherjee said.

Aggarwal is pitching its residential battery solution to investors, which could be a sign that the scooter business is losing steam.

However, the challenges in this space are immense. Players like Exide and Amara Raja dominate the Indian battery storage market, and these companies have strong financials, deep trust capital, extensive distribution networks, and strong after-sales infrastructure.

Ola, on the other hand, is building from scratch at a time when its balance sheet is already strained. Additionally, lead-acid batteries largely dominate residential backup solutions in India, and Ola is attempting to sell premium lithium-ion systems priced between INR 29,000 and INR 1,59,999, which is significantly above mass-market affordability.

Given the credibility crisis arising from its electric vehicle operations, persuading consumers to trust Ola with home power systems could prove to be an uphill battle for Aggarwal.

However, despite the setbacks, the year was not entirely bleak for Ola Electric. The company unveiled its Gen 3 platform, which it says offers greater power efficiency and improved security validation, advancements it hopes will reduce warranty expenses over time.

Additionally, the integration of its internal battery packs into vehicles is expected to strengthen unit economics. Ola also anticipates that its Hyperpure vertical will evolve into a high-margin business, providing a fresh tailwind amid an otherwise challenging year.

Last month, the company also received certification for a rare earth-free ferrite motor, meaning it can now develop the motor in-house, thereby eliminating reliance on imported components of rare earth materials.

Ultimately, Ola Electric’s struggles in 2025 reflect an erosion of trust, repeated failures in execution and a faltering strategic approach. Can Ola return in 2026?

Edited by Shishir Parasher