US President Donald Trump’s hike in H-1B visa fees – a key visa program – may have limited impact on India’s IT sector which currently uses this visa provision extensively. Trump has introduced a weighted H-1B visa selection criteria and also increased the application fee to $100,000.In fact, India’s unique talent pool will be its biggest strength in dealing with the US immigration crackdown, according to a new report by Moody’s Ratings.“Changes in US immigration policy, including the $100,000 H-1B visa application fee, are likely to slow growth in India’s service-sector exports. Operating costs for India’s IT services sector, which represents about 80% of its total services exports, will increase. However, companies’ high profitability, strong financial position and persistent skills shortage in the US will partially offset the impact of the new restrictions,” Moody’s says.

Indian IT Sector resilience

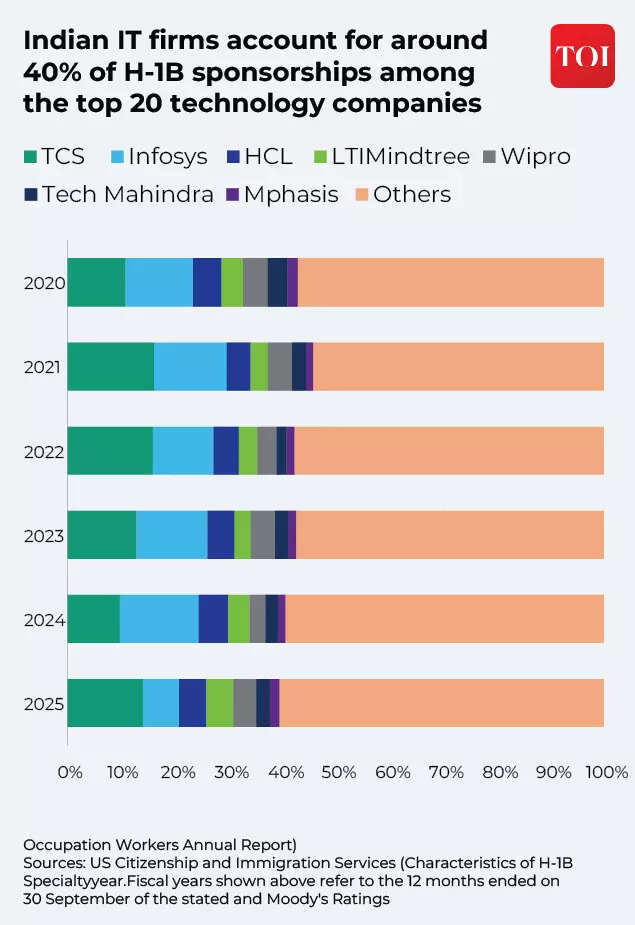

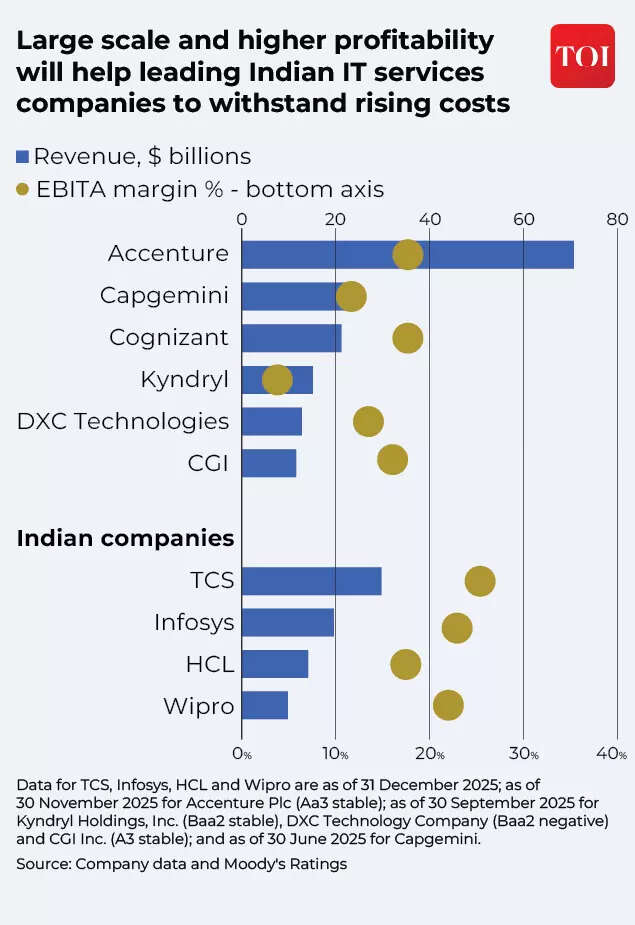

Dependence on H-1B visas is high in the computer-related technology sector, accounting for approximately 70% of H-1B visas issued in the last 5 years. It is actually the largest consumer of the H-1B program. Indian IT sector companies like TCS, infosys Among the top sponsors of H-1B visas. Other companies like HCL Tech, Wipro, Tech Mahindra, LTIMindry, Mphasis are also major users of this visa program.The model is simple: Deploy employees from offshore locations like India, where there is a large supply of skilled talent, to on-site customer locations in the US. This is the reason why these companies rely heavily on H-1B visa.Moody’s believes most of these IT sector companies will be able to absorb the higher visa costs without a significant deterioration in their operational or financial profiles. “Companies like TCS, Infosys, Wipro and HCL Technologies benefit from significant operating scale and rank among the world’s largest IT service providers by revenue. Furthermore, their EBITA margins of 19%-26% are higher than global competitors, which range between 10%-17%. The high profitability of Indian IT services companies enhances their ability to absorb cost increases,” says Moody’s.

Even if Indian IT companies maintain historic levels of H-1B visa sponsorship, the resulting increase in operating expenses – which Moody’s estimates at $100 million to $250 million – will be only around 1% of revenues.“Even with the full cost burden, the EBITDA margin impact will be limited to about 100 basis points, resulting in Indian IT services companies being more profitable than their global peers. Additionally, many of these companies maintain adequate net cash positions, strengthening their financial strength,” Moody’s said in its report.

However, the report notes that small and medium-sized companies may find it difficult to afford these additional costs.

What does this mean for India’s services exports?

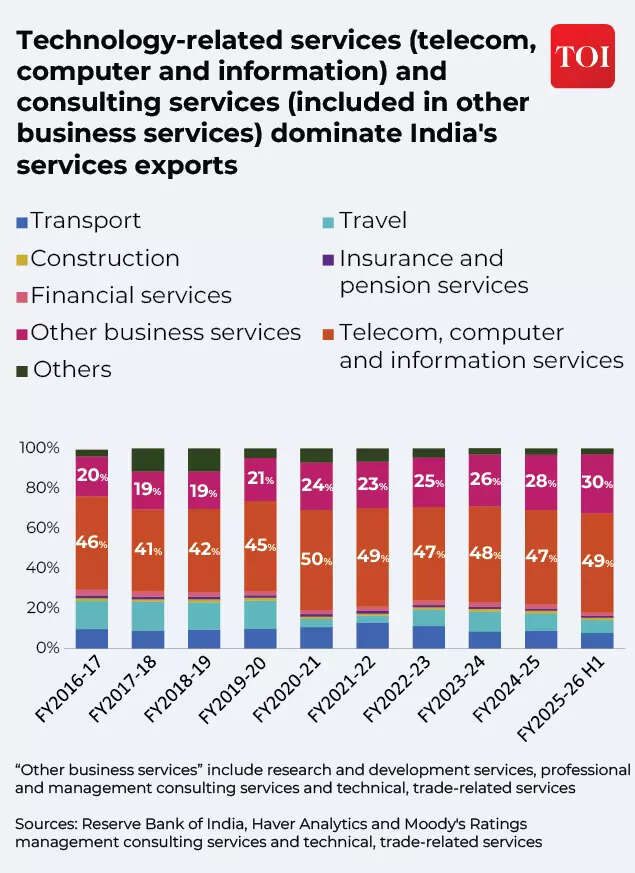

The Indian IT sector is the backbone of the country’s services exports. India’s services exports have witnessed significant growth in the last decade or so. They have grown at a CAGR of 12% from FY 2016-17 to FY 2024-25. In fact, services exports now account for almost half of India’s total exports. According to India Brand Equity Foundation, they may overtake goods exports by 2030.Technology-related services such as telecommunications, computer and information services) and other business services such as research and development, and consulting services play a major role in the export of other services. For India, these two service-export sectors account for about 80% of total service exports. These have seen a CAGR of 12% and 16% respectively during the same period.

The ongoing changes in US immigration policies under the Trump administration are likely to increase costs for Indian IT companies, which in turn may impact services exports, hampering its growth prospects in the US market.However, Moody’s said in its report that the negative impact will be partially mitigated by increased local hiring in the US as a result of continued demand for skilled IT workers from US companies, proximity and expansion of Global Capability Centers (GCC) in India.“Large Indian IT services companies have strong profitability, solid balance sheets and strong cash reserves that support their credit strength,” it said.Currently, the United States is India’s largest market for services exports, so the IT sector is exposed to risks arising from the Trump administration’s immigration policies.What are software services? According to RBI, these are computer services and IT-enabled services, including business process outsourcing services.According to RBI data cited by Moody’s, exports of software services by Indian companies increased by 7.3% to $204.7 billion during fiscal year 2024-25. “The proportion of on-site services, subject to visa restrictions, is about 10% of total software services exports. Higher growth in software services exports to Europe and increased local hiring in the US by Indian companies will offset some of the impact of US immigration restrictions,” Moody’s says.

It is also important to note that Europe is also becoming a major player in India’s software services exports, and the dependence on H-1B visas is decreasing.“The share of exports to Europe increased from 23% in FY 2016-17 to 33% in the most recent fiscal year, while for the US it declined to 53% from about 60% in FY 2016-17,” Moody’s says.Furthermore, on-site services declined from 17.2% to 9.3% of total software services exports over the eight-year period, indicating a decline in dependence on Visa.The recently announced India-EU Free Trade Agreement also has the potential to further increase India’s services exports to the EU. This will benefit India’s IT service providers apart from other service sectors.

Victory of India’s unique talent

India is uniquely positioned to bridge the talent gap that the US faces. Moody’s reported that the US faces a growing labor shortage due to a declining birth rate and a rapidly aging population.“The U.S. Bureau of Labor Statistics projects that the nation’s labor force participation rate will remain below pre-pandemic levels for the next decade, even as demand for skilled labor continues to grow across many industry sectors,” Moody’s says.The report cites a key example: the U.S. computer and information technology sector will open up about 300,000 jobs annually by 2034. This will be driven by digitalization and AI adoption. However, only about 100,000 computer science graduates with U.S. citizenship or permanent residence enter the workforce each year. This means that there is a shortage of 2 lakh posts every year which needs to be dealt with.Fundamentally, the above example helps understand the role that foreign talent will continue to play in America’s economic growth. “The current period of slow economic growth and weak labor market may temporarily mitigate the impact of immigration restrictions. “However, prolonged restrictions will lead to talent shortages and are likely to hinder innovation, delay digital transformation programs and reduce competitiveness in emerging technologies such as AI – especially given the growing contribution of AI-related investments to real gross domestic purchases,” Moody’s says.So what does this mean for India? According to Moody’s, India is “uniquely positioned” to bridge this gap, given its large, English-speaking and technically skilled workforce. As reported, 70%-75% of all H-1B visas issued since 2020 are to Indian citizens. This reflects India’s surprising share in meeting the demand for skilled labor in the US. Moody’s says, “India produces about 2.5 million STEM (science, technology, engineering and mathematics) graduates annually, compared to about 850,000 STEM graduates in the US, highlighting its role as a major talent supplier to the technology sector.” Moody’s says, “Even as US companies explore options such as closer proximity to neighboring countries or expansion in the GCC to different countries, domestic shortages ensure that foreign talent – particularly from India – will remain critical to US technology growth. As a result, demand for Indian IT services will remain stable despite stringent US immigration policies.”

GCC benefits for India

Moody’s also notes that the need for US tech companies to get access to skilled workers could increase their appetite to set up their own GCCs in India. This will encourage foreign direct investment in India. India’s current account deficit will widen modestly due to weak growth in services exports and a decline in worker remittances due to a decline in the inflow of skilled workers to the US, the report said.“Remittances accounted for between 7% and 10% of current account receipts over the past five fiscal years. However, increasing demand for skilled workers in other countries may partially offset the negative impact. Additionally, the potential return of high-skilled IT workers and other Indian nationals to India due to reduced job prospects in the US could also boost India’s IT ecosystem and capacity, thereby attracting more India-based business to the GCC,” Moody’s says.

The role of AI-powered automation

Moody’s believes the role of the H-1B visa will diminish over time due to the rapid adoption of artificial intelligence (AI) tools. Indian IT giants like TCS and Infosys are now betting on generative AI for a range of offerings like maintenance, testing and routine coding, according to Moody’s. It added that with increasing investment in AI, the need for staff will reduce, especially in on-site customer locations.However, it is important to note that AI investments come at capital and strategic costs. Moody’s For example, TCS recently announced that it will invest $6 billion-$7 billion to build one gigawatt of data center capacity over the next few years, “with capital expenditure steadily increasing on building out AI infrastructure, employee training and reskilling, and ecosystem participation.” “In the medium term, AI adoption will improve delivery efficiency, reduce reliance on visa-dependent on-site roles and generate additional revenue streams in new service lines,” the Moody’s report said.Still, the timing mismatch between upfront investments and productivity gains means free cash flows will remain under pressure over the next 1-2 years, especially as companies balance these outlays with shareholder returns and wage inflation, it adds.