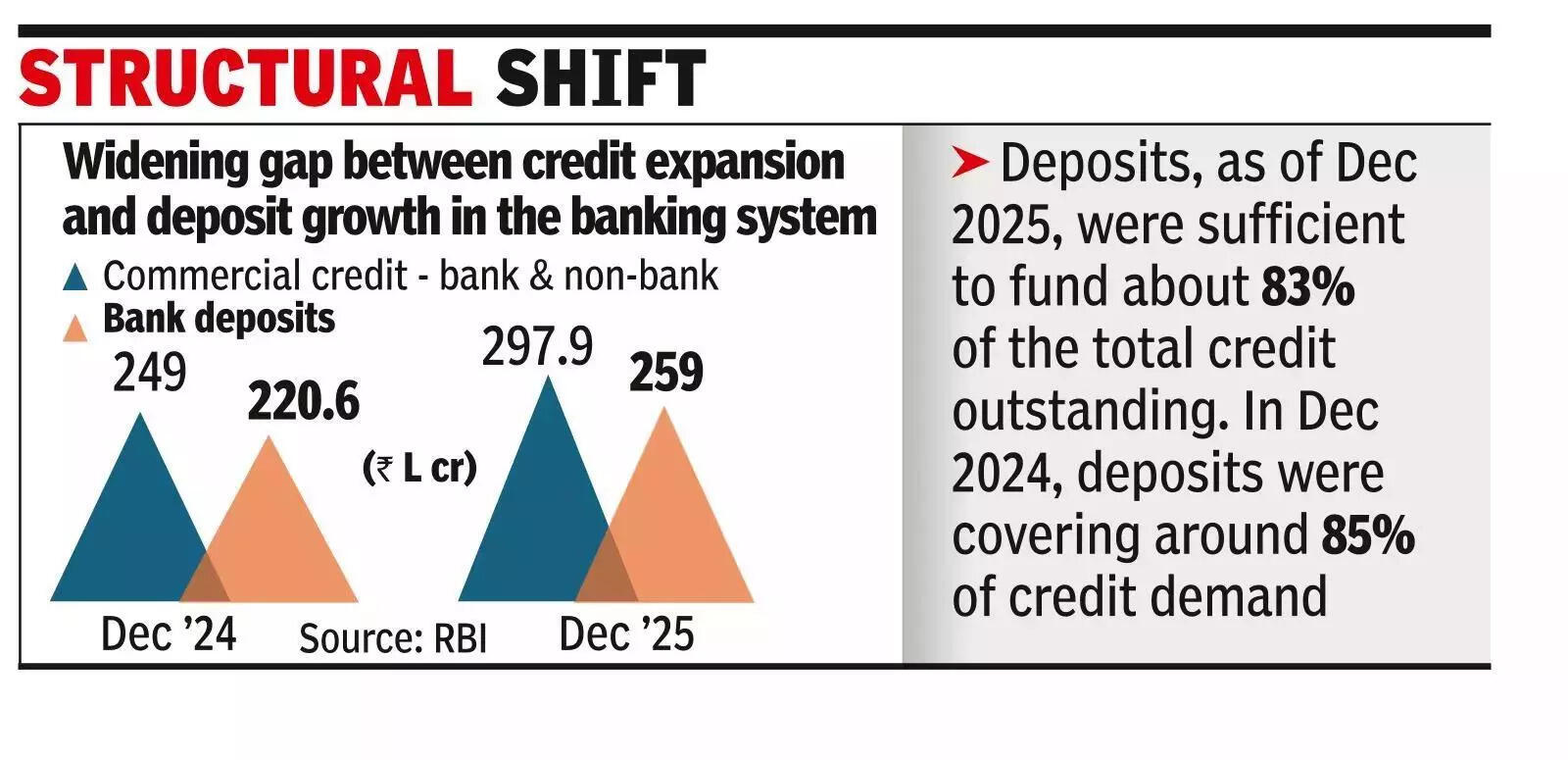

MUMBAI: India’s bank depositors remain the major source of credit for the commercial sector, but their relative contribution has been declining steadily as credit growth outpaced deposit mobilization, December 2025 data showed.By December 2025, total outstanding credit to the commercial sector (banks and non-banks) increased to Rs 297.9 lakh crore, while bank deposits stood at Rs 249 lakh crore. Deposits were only sufficient to cover about 83% of total outstanding loans. A year ago, in December 2024, bank deposits stood at Rs 220.6 lakh crore against total credit of Rs 259.01 lakh crore, covering about 85% of the credit demand. The data points to a growing gap between credit expansion and deposit growth in the banking system.

.

This trend reflects structural changes in India’s credit landscape. Banks remain central to financing the commercial sector, but their deposit base no longer keeps pace with credit demand. NBFCs’ growing reliance on bond markets and foreign borrowing reflects both deepening financial markets and increasing pressure on bank balance sheets as demand for credit continues to grow.The first nine months of 2025-26 witnessed a sharp acceleration in credit flows to the commercial sector. While banks continue to operate this system, the pace of credit creation has become increasingly dependent on non-bank channels.Non-food bank loans remained the largest source of incremental financing. Between December 2024 and December 2025, bank credit expanded by Rs 25.5 lakh crore, accounting for 65.5% of the total growth in commercial sector credit. The outstanding non-food bank credit at the end of December 2025 stood at Rs 202.3 lakh crore, showing a growth of 14.4% year-on-year.